Cloud River Urban Research Institute

Editor’s note:

How much box office revenues will be generated during this year’s Chinese New Year, which is a traditionally big season for cinemas? Which country had the highest box office revenue in 2021? Which Chinese city had the highest box office revenue? Which Chinese city spent most on movie tickets? How Chinese movies made their way into the global top 10 earners? Based on the “Index of Chinese Cities’ Cinema Spending” included in its annual China Integrated Index, Cloud River Urban Research Institute will to give answers to these questions in detail with illustrations.

1. China continues to be the world’s largest movie market for two years straight

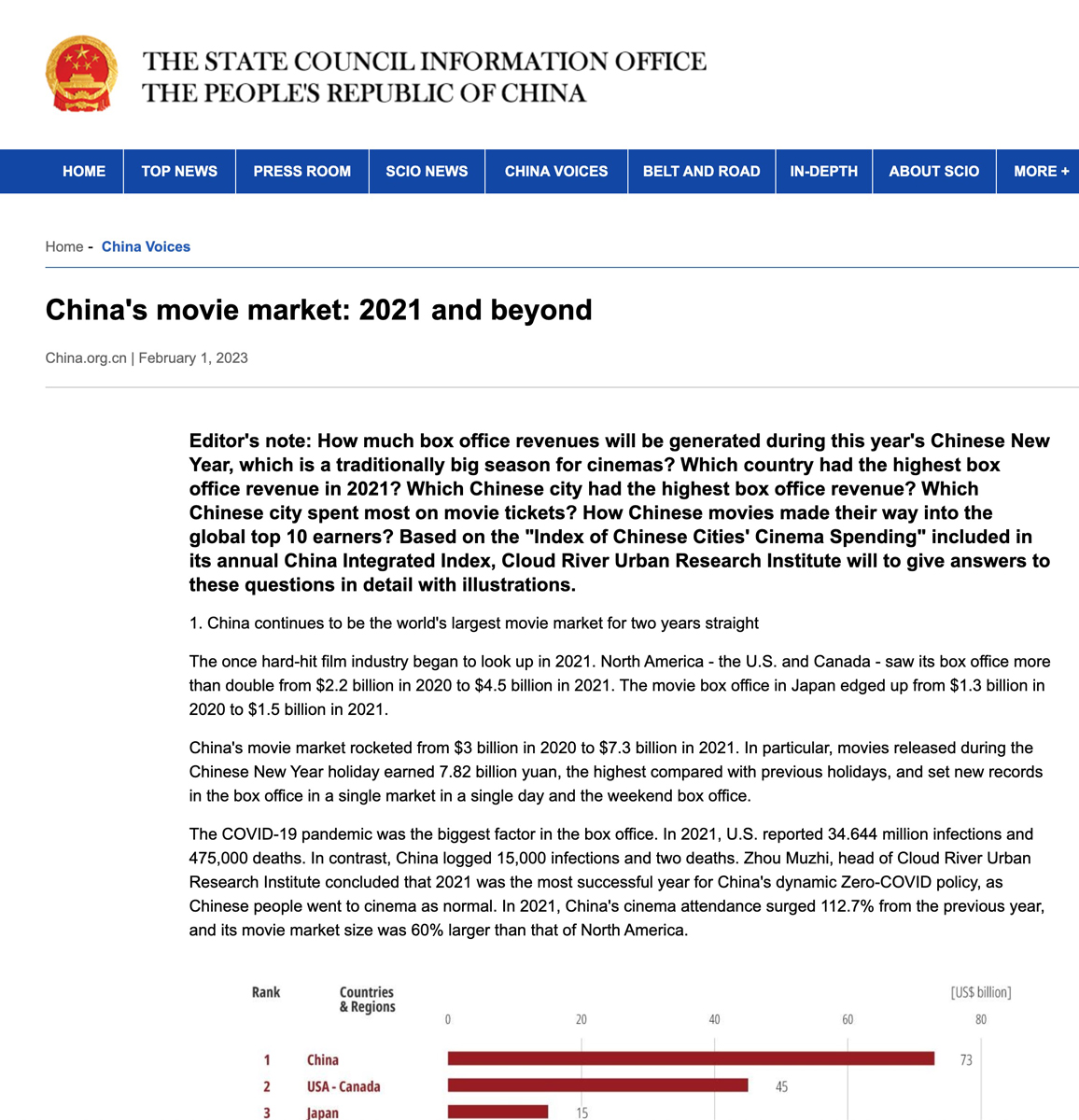

The once hard-hit film industry began to look up in 2021. North America – the U.S. and Canada – saw its box office more than double from $2.2 billion in 2020 to $4.5 billion in 2021. The movie box office in Japan edged up from $1.3 billion in 2020 to $1.5 billion in 2021.

China’s movie market rocketed from $3 billion in 2020 to $7.3 billion in 2021. In particular, movies released during the Chinese New Year holiday earned 7.82 billion yuan, the highest compared with previous holidays, and set new records in the box office in a single market in a single day and the weekend box office.

The COVID-19 pandemic was the biggest factor in the box office. In 2021, U.S. reported 34.644 million infections and 475,000 deaths. In contrast, China logged 15,000 infections and two deaths. Zhou Muzhi, head of Cloud River Urban Research Institute concluded that 2021 was the most successful year for China’s dynamic Zero-COVID policy, as Chinese people went to cinema as normal. In 2021, China’s cinema attendance surged 112.7% from the previous year, and its movie market size was 60% larger than that of North America.

Source: produced by Cloud River Urban Research Institute based on the Motion Picture Association’s 2021 THEME Report

2. China’s biggest earners in 2021

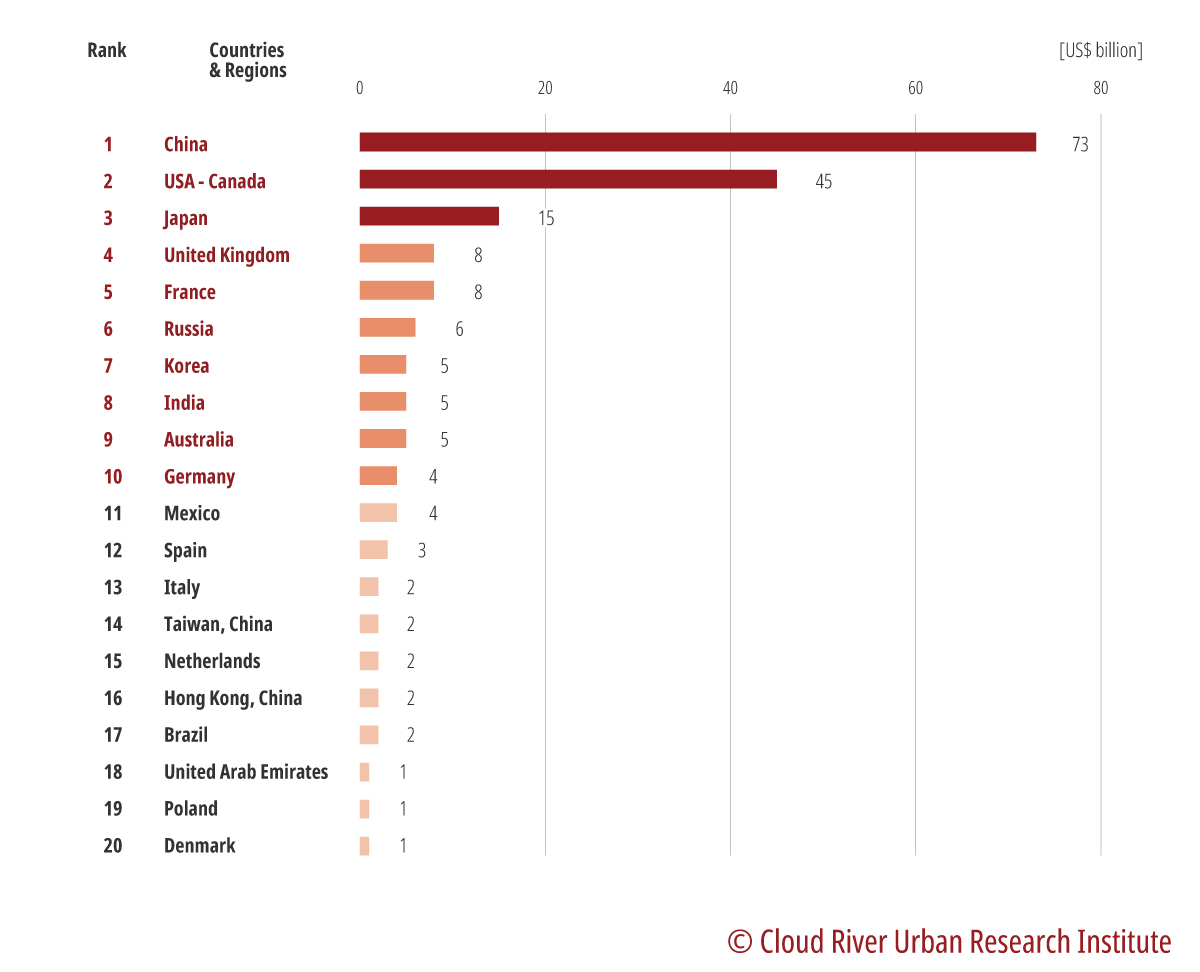

Among the 10 highest-grossing movies in 2021 globally, “The Battle at Lake Changjin, ” “Hi, Mom, ” and “Detective Chinatown 3” ranked second, third, and sixth, respectively.

Mamoru Shirai, executive chairman of PIA Global Entertainment Corporation, said China’s movie market expanded rapidly despite the COVID-19 headwinds and that three Chinese movies made the list of the 10 highest-grossing movies in the world, each raking in more than $500 million at the box office.

However, An Ting, chairman of Chicpia, an entertainment company, said that movie, like performance, is kind of art that needs people to watch. Cinemas and theaters are places where audiences are willing to spend. How willing an audience is to spend depends on the quality and influence of a movie. In an environment where people are deluged with a vast body of visual and acoustic information, the movie industry has to figure out ways to stand out and turn people who watch to people who appreciate.

A remarkable thing was that the revenues of the three blockbusters almost came from the Chinese market. Zhou said, the fact that the sole Chinese market catapulted these movies into the top echelon demonstrated the sheer size of the Chinese market and domestic productions’ dependence on the home turf. How to make inroads into the global market is a challenge facing Chinese movie productions. Japan, Australia and New Zealand only contributed a meager 0.3% of revenues of “Detective Chinatown 3.”

Mamoru said he hoped Chinese filmmakers would present global audiences with blockbuster films, including world-class animation films.

China is a colossal market for foreign movies. For instance, “Fast and Furious” at fifth place and “Godzilla vs Kong” at eighth place raked in $220 billion and $190 million in the Chinese market, representing 29.9% and 40.1% of their global box office, respectively.

The lure of the Chinese market has prompted Hollywood producers to infuse Chinese elements into their productions. At the same time, Chinese directors, Chinese actors, as well as Chinese investors have actively participated in the making of Hollywood movies. Chinese companies, for instance, were involved as investors in Oscar-winning movies “The Revenant” and “Green Book.” Zhou said such international exchanges have played a big role in enhancing the quality of Chinese movies.

Source: produced by Cloud River Urban Research Institute based on data offered by Box Office Mojo, a U.S. website that tracks box-office revenue

3. Which Chinese city tops box office?

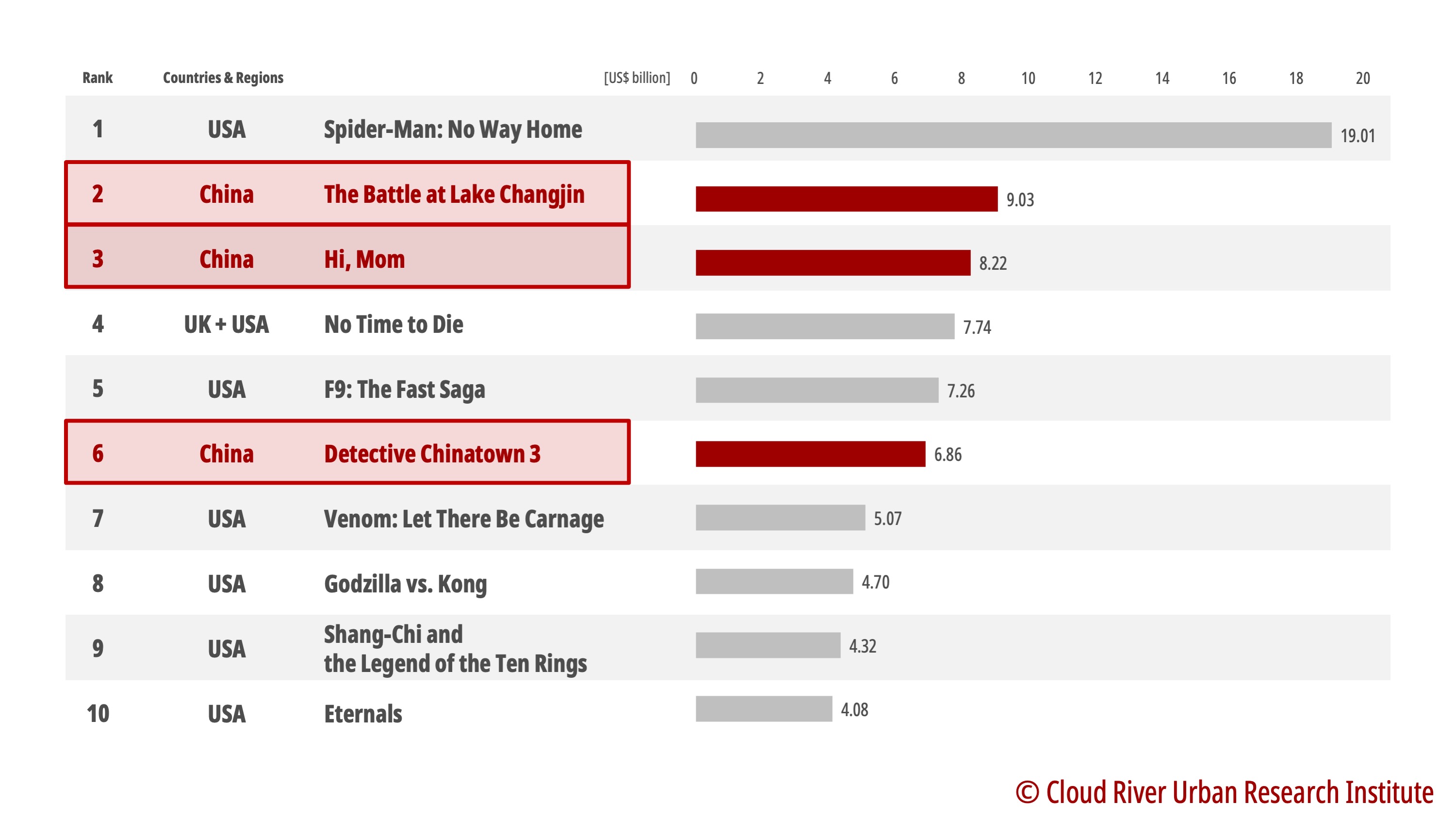

Cloud River Urban Research Institute annually released the “Index of Chinese Cities’ Cinema Spending” for 297 Chinese cities at prefecture level and above, drawing on its annual China Integrated City Index.

Shanghai, Beijing, Shenzhen, Chengdu, Guangzhou, Chongqing, Hangzhou, Wuhan, Suzhou, and Changsha made the top 10. Changsha replaced Xi’an to take the 10th spot. Places from 11th to 30th were Xi’an, Nanjing, Zhengzhou, Tianjin, Dongguan, Foshan, Ningbo, Hefei, Wuxi, Qingdao, Shenyang, Kunming, Wenzhou, Nantong, Nanchang, Fuzhou, Jinan, Jinhua, Nanning, and Changchun.

Cinema attendance in most Chinese cities doubled as the pandemic was brought under control and people’s life returned to normal in China in 2021.

Source: produced by Cloud River Urban Research Institute based on its annual China Integrated Index

4. Cinemas cluster in certain Chinese cities

The data of the “Index of Chinese Cities’ Cinema Spending in 2021” indicates that certain Chinese cities are a magnet for the film market.

The top five cities by cinema numbers accounted for 12.6% of the national total in 2021, the top 10 cities 20.9%, and the top 30 cities 39.4%. That means the top 10 cities contributed one fifth of the country’s cinema resources, and the top 30 cities contributed nearly 40%. The concentration of national cinema resources remained almost the same as the previous year.

The top five cities in terms of cinema attendance accounted for 16.9% of the national total, the top 10 cities 27.4%, and the top 30 cities contributed a staggering 48.9%. That means the top 10 cities made up nearly one third of cinema attendance nationwide and top 30 cities nearly half of the national total.

Zhou pointed out that compared with cinema numbers, cinema attendance is more likely to concentrate in certain cities. However, he also noted that as cinema attendance increased in some cities, the concentration rate of per capita cinema attendance fell slightly from the previous year.

The top five cities in terms of cinema spending accounted for 19.7% of the national total, the top 10 cities 30.1%, and the top 30 cities 51.1%. That means the top 10 cities generated one third of the nation’s box office and the top 30 cities contributed more than half of the nation’s total box office. The concentration rate of box office in China dropped slightly from 2020 levels.

Mamoru noted that the concentrations of cinema attendance and box office shows the emergence of markets in other Chinese cities and points to enormous potential of the Chinese movie market.

5. A glance at traits of Chinese cities

The data of the “Index of Chinese Cities’ Cinema Spending in 2021” also reflects differences among Chinese cities in cinema spending.

The top 10 cities in terms of box office were Shanghai, Beijing, Shenzhen, Chengdu, Guangzhou, Chongqing, Hangzhou, Wuhan, Suzhou, and Changsha.

The top 10 cities in terms of cinema attendance were Shanghai, Beijing, Chengdu, Shenzhen, Guangzhou, Chongqing, Wuhan, Hangzhou, Suzhou, and Xi’an.

The top 10 cities in terms of per capita cinema attendance were Zhuhai, Wuhan, Hangzhou, Nanjing, Shenzhen, Shanghai, Beijing, Haikou, Guangzhou, and Changsha.

The top 10 cities in terms of per capita box office were Beijing, Shanghai, Shenzhen, Hangzhou, Zhuhai, Nanjing, Wuhan, Guangzhou, Sanya, and Haikou.

Zhou suggested that the set of indexes honestly and interestingly reflects traits and personalities of Chinese cities.

The article was first published on China SCIO, China.org.cn on Feb. 1, 2023 and reprinted by other news websites.