Cloud River Urban Research Institute

Editor’s note:

How hard was China’s air transportation battered by the COVID-19 pandemic? Which Chinese city has the most airport convenience? Which industry relies most on air transportation? Cloud River Urban Research Institute draws on the index of airport convenience included in its China Integrated City Index to answer these questions in detail with illustrations.

Air travel takes a nose dive in 2020, but air cargo doesn’t

The COVID-19 pandemic that emerged in 2020 forced countries to close their borders, and thus the air transportation industry suffered from an unprecedented blow. Affected by restricted international travel and city lockdowns in the first half of 2020, the number of China’s air travelers slumped by 36.6% in 2020. Fortunately, China’s airline sector began to look up shortly after the pandemic was swiftly brought under control in the country. Compared with its Western counterparts, China’s airline industry suffered a smaller decrease in the number of air travelers.

Against the sharp loss in air travelers, China’s air cargo only slipped by 6% in 2020. This shows that despite COVID-19, China’s logistics sector was still brisk and manufacturing supply chains recovered quickly.

Which Chinese city has the most airport convenience?

The transportation hub function is crucial to a city and can strengthen and amplify other hub functions of a city. The China Integrated City Index, compiled by Cloud River Urban Research Institute, uses the index of airport convenience to analyze and evaluate airports in 297 Chinese cities at prefecture level and above.

Airport convenience is an index based on the airport capacity and the distance between the urban hub and the airport, taking account into the number of airport passengers, the volume of air cargo, the number of flights, punctuality rates, and the number and the length of runways.

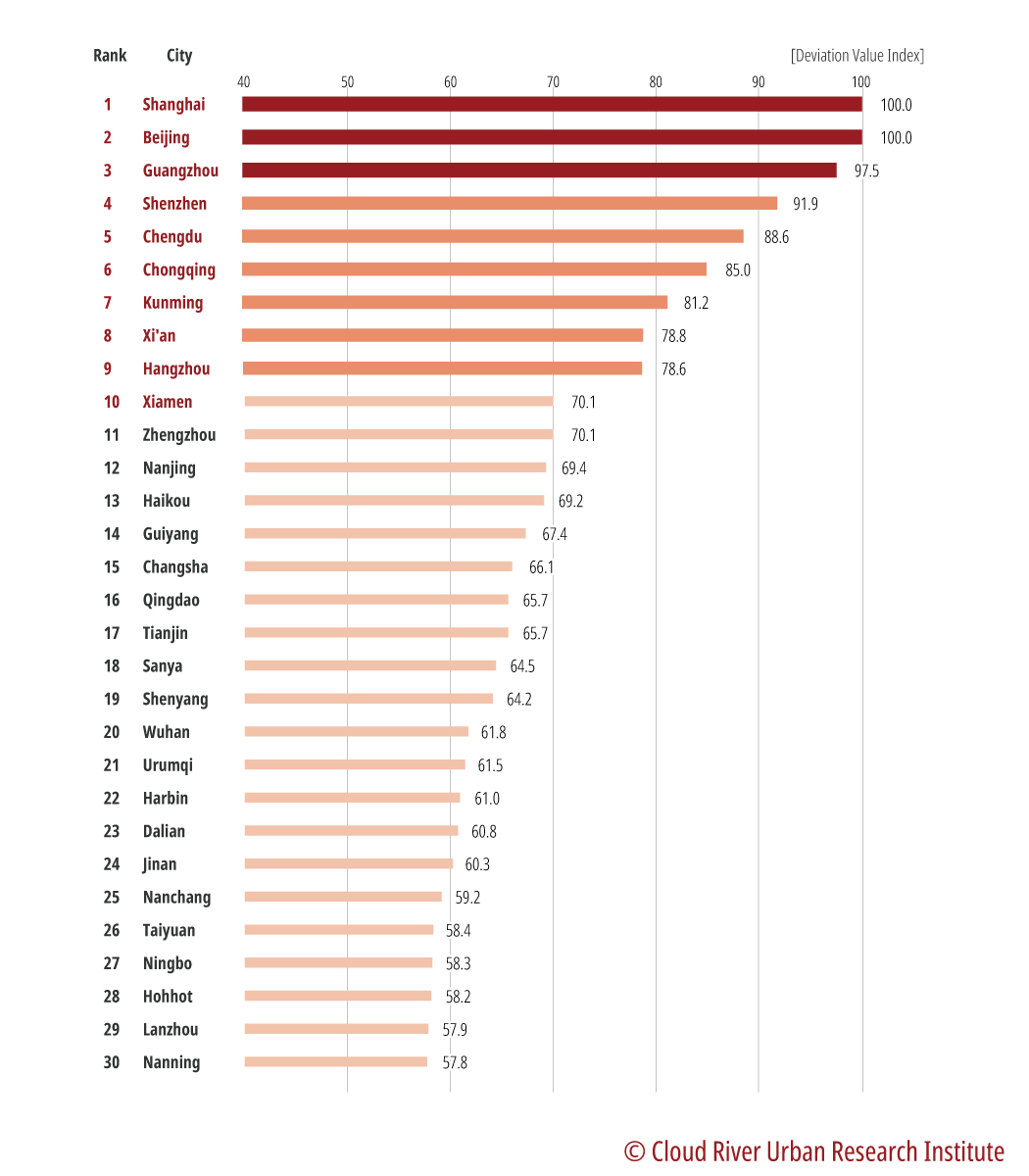

As shown in Figure 1, the top 10 cities by airport convenience in 2020 were Shanghai, Beijing, Guangzhou, Shenzhen, Chengdu, Chongqing, Kunming, Xi’an, Hangzhou, and Xiamen, which are all central cities. The rankings remained the same as they were in 2019.

Eleventh to 30th places were taken by Zhengzhou, Nanjing, Haikou, Guiyang, Changsha, Qingdao, Tianjin, Sanya, Shenyang, Wuhan, Urumqi, Harbin, Dalian, Ji’nan, Nanchang, Taiyuan, Ningbo, Hohhot, Lanzhou, and Nanning, which are all central cities except resort island Sanya.

Zhou Muzhi, head of Cloud River Urban Research Institute, pointed out that the rankings show that China’s air transportation concentrates mainly in the Beijing-Tianjin-Hebei region, the Yangtze River Delta, and the Pearl River Delta. Air transportation is the most important transportation infrastructure to prop up the development of inland hub cities such as Chengdu, Chongqing, Kunming, and Xi’an. Chinese cities with abundant tourism resources moved up in the ranking in 2020 as they became destinations for domestic travelers when the pandemic interrupted international travel.

Figure 1 Top 30 cities by airport convenience in 2020

Airport functions gravitate toward central cities

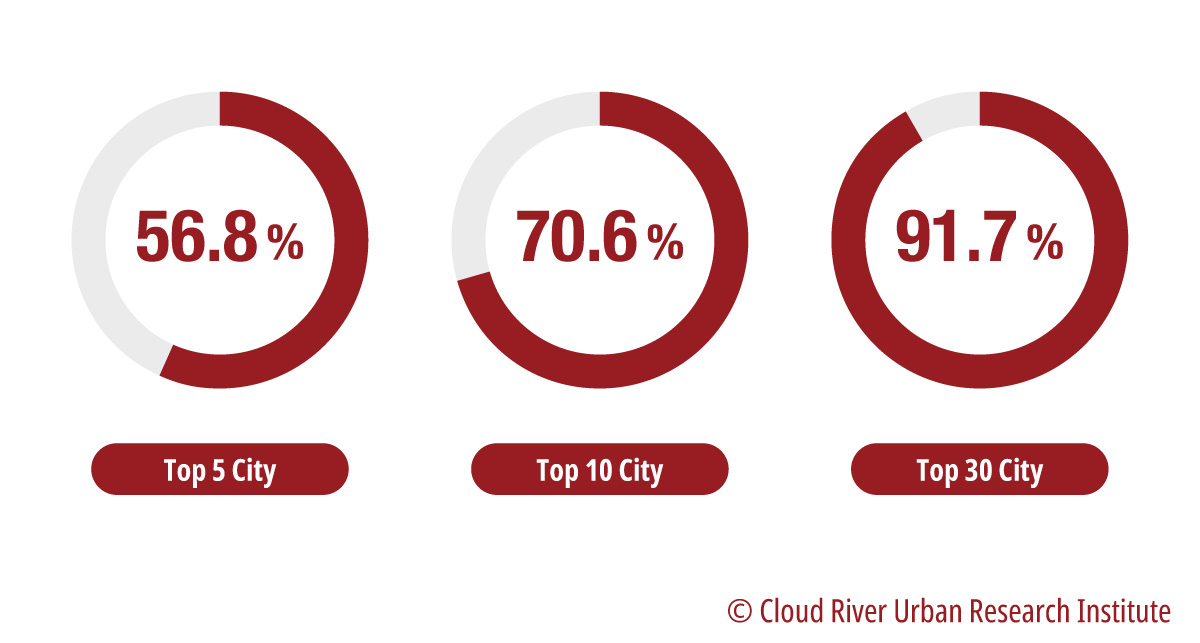

The top five cities in the rankings accounted for a combined 28.1% of the nation’s total airport passengers, the top 10 accounted for 45.5%, and the top 30 accounted for 77.4%. This shows China’s air transportation concentrates in these high-ranking central cities.

Figure 2 Concentration of airport passengers in Chinese airports in 2020

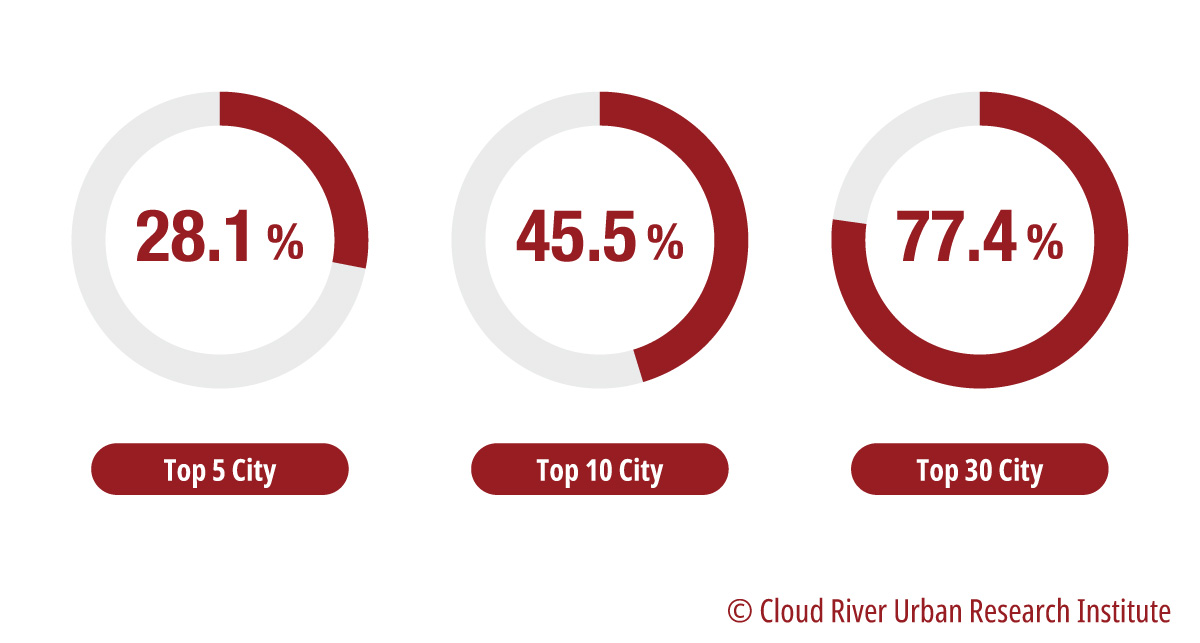

Moreover, the top five cities in the rankings accounted for a combined 56.8% of the nation’s air cargo, the top 10 accounted for 70.6%, and the top 30 accounted for a staggering 91.7%. A noteworthy thing is that among these cities, Shenzhen, Hangzhou, Zhengzhou, Nanjing, Changsha, Ji’nan, and Nanchang saw their air cargo volumes go up instead of down in spite of the pandemic.

Zhou concluded that compared with air passengers, air cargo is more likely to concentrate in central cities.

Figure 3 Concentration of air cargo in Chinese cities in 2020

Correlation between IT industrial development and airport convenience

Cloud River Urban Research Institute looks at how the manufacturing industry and the IT industry correlate with airport convenience, container port convenience, and railway convenience in 297 Chinese cities at prefecture level and above.

Container port convenience correlates most with the strength of the manufacturing industry with a ratio of 0.65. This explains why the manufacturing industry largely concentrates in coastal areas that are better served by ports. In contrast, the manufacturing industry correlates weakly with airport convenience, with a ratio of 0.48.

In contrast, the IT industry correlates strongly with airport convenience, with a ratio of 0.65.

Zhou suggested that air transportation not only underpins the global supply chain, but also makes it possible that people can travel through space. He also added that the development of the IT industry, a kind of exchange economy, requires people-to-people exchanges that entail the support of air transportation.

The article was first published on China SCIO, China.org.cn on Sep. 6, 2022 and reprinted by other news websites.