Cloud River Urban Research Institute

Editor’s note:

Why do we say affluent Chinese cities are as rich as some countries? Why do we consider megalopolises as the main form to promote urbanization? In the major economic rankings of China Integrated City Index 2022, Cloud River Urban Research Institute utilizes a series of economic data to look into the dynamics of the 10 wealthiest cities and first-tier and quasi-first-tier megalopolises in China.

Top 10 cities on major economic rankings

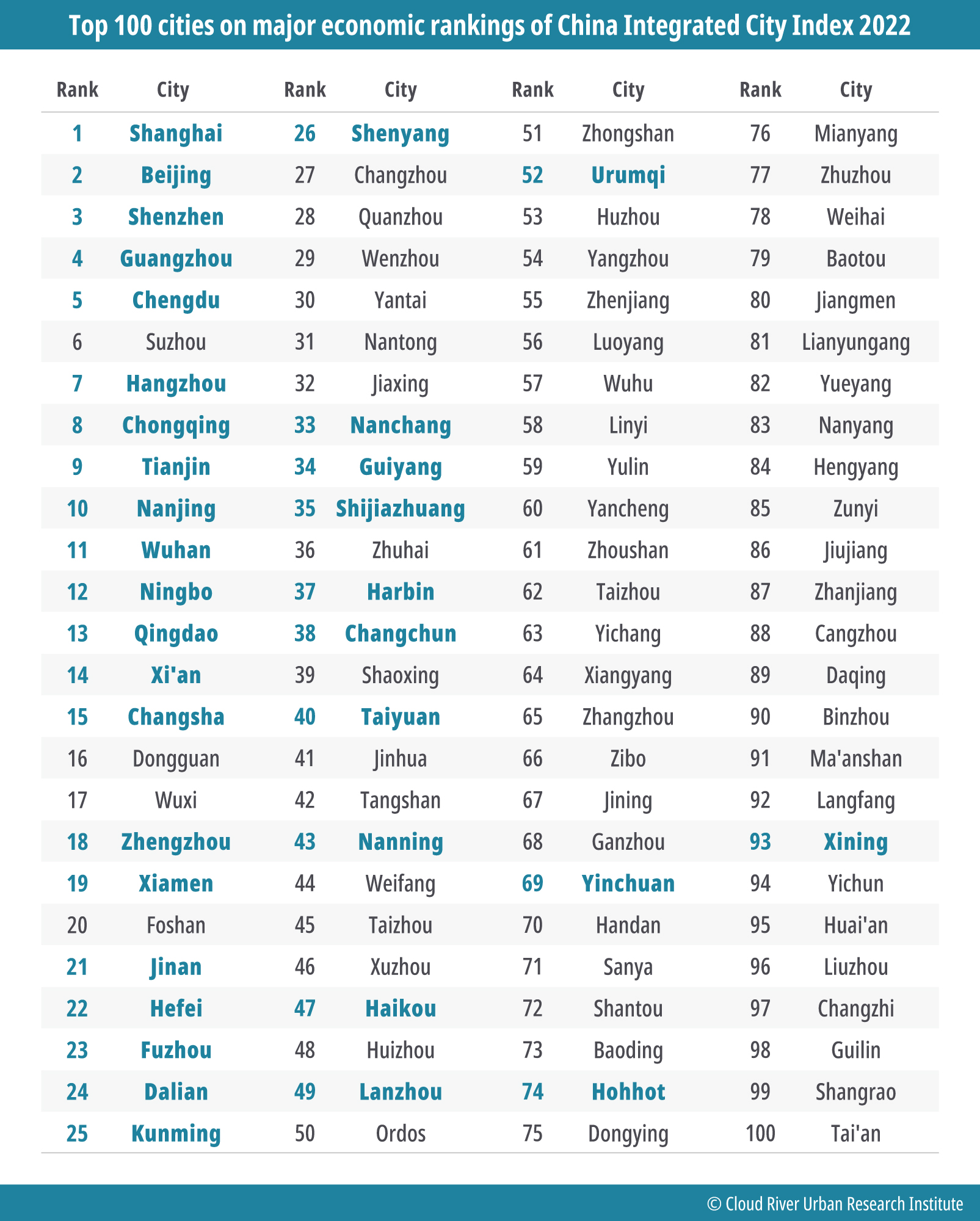

According to the major economic rankings of China Integrated City Index 2022 (hereinafter referred to as the Index), the top 10 cities are Shanghai, Beijing, Shenzhen, Guangzhou, Chengdu, Suzhou, Hangzhou, Chongqing, Tianjin, and Nanjing. Compared to 2021 rankings, Chengdu moves from 6th to 5th, Suzhou drops from 5th to 6th, Hangzhou advances from 8th to 7th, and Chongqing declines from 7th to 8th.

Ming Xiaodong, former first-level inspector of the Department of Development Planning of the National Development and Reform Commission and former minister-counsellor of the Chinese Embassy in Japan, said the top 20 cities on the rankings include all first-tier cities, quasi-first-tier cities, and seven second-tier cities.

He noted the rankings are based on nine sub-indicators including economic aggregate, economic structure, economic efficiency, business environment, openness, innovation and entrepreneurship, urban-rural integration, broad hub, and leading power, involving 227 sets of data.

He said the rankings fully illustrate that first-tier cities are the main growth engines of China’s economy, while quasi-first-tier cities and some second-tier cities are the new driving forces of China’s economic development.

Professor Zhou Muzhi, head of Cloud River Urban Research Institute, pointed out that as the main growth engines and new sources of China’s economic development, these cities can be as wealthy as some nations.

He said GDP of some cities among the top 10 is approaching or even outstripping that of the countries ranked from 20th to 47th globally, and that the total economy of these top 10 cities accounts for 22.6% of China’s GDP and 4.7% of the world’s GDP, exceeds Germany’s GDP (ranked 4th), and approaches Japan’s GDP (ranked 3rd).

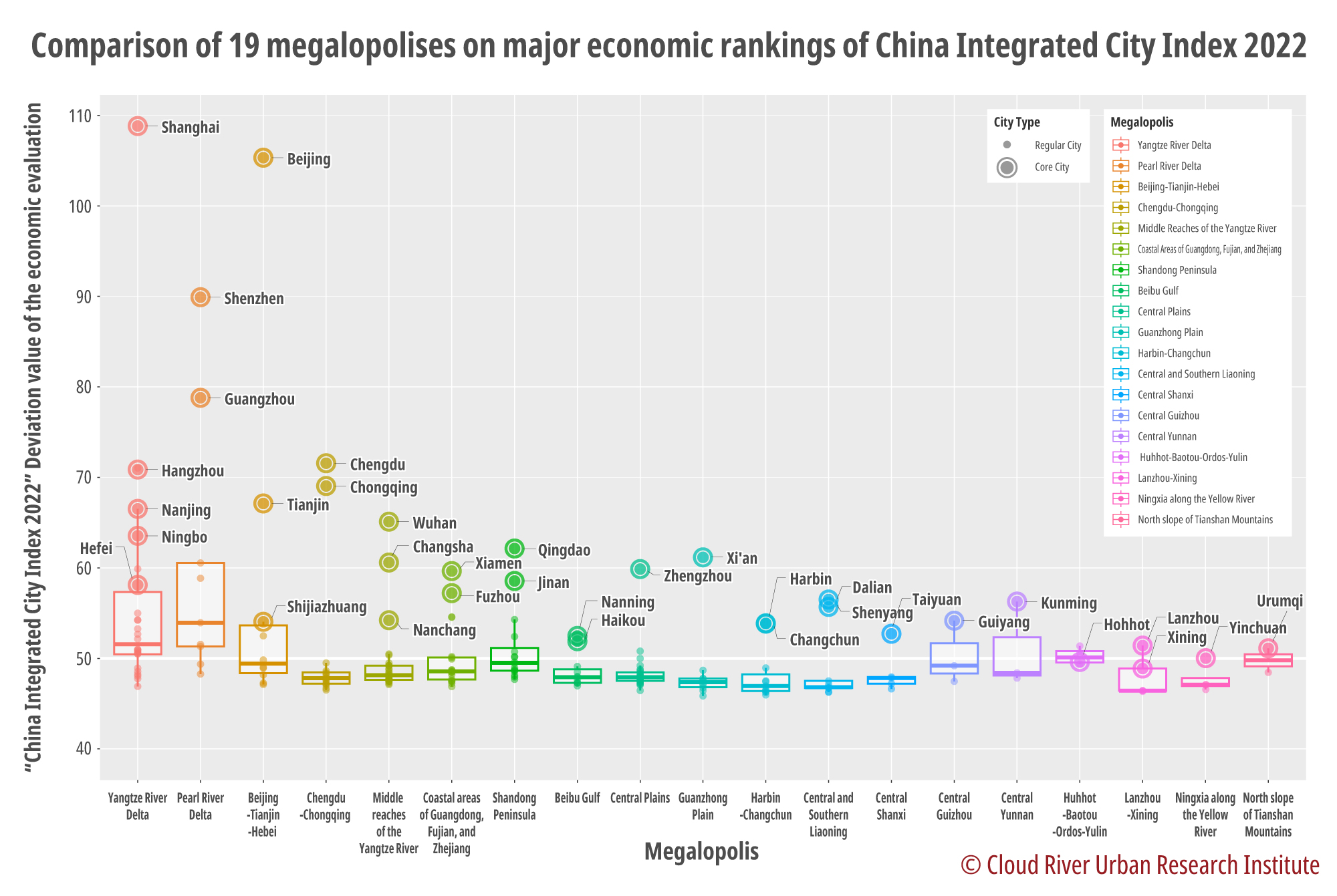

According to the comprehensive deviation values, the Index classifies the 297 cities at the prefecture level and above into first-tier, quasi-first-tier, second-tier, and third-tier cities. Further, it defines 19 megalopolises as first-tier, quasi-first-tier, second-tier, and third-tier megalopolises based on the hierarchical level of leading regional core cities. This article focuses on the analysis of the economic performance of first-tier and quasi-first-tier megalopolises in 2022.

Top 100 cities on major economic rankings of China Integrated City Index 2022

Three major megalopolises lead China’s socioeconomic development

Led by the four first-tier cities — Beijing, Shanghai, Shenzhen, and Guangzhou, the Yangtze River Delta, the Pearl River Delta, and the Beijing-Tianjin-Hebei region are the three major megalopolises driving the socioeconomic development of China.

In 2022, the Yangtze River Delta accounted for 20% of China’s GDP, the Pearl River Delta 8.6%, and the Beijing-Tianjin-Hebei region 7.5%. These three major megalopolises collectively generated 36.2% of the country’s GDP. In 2022, the Yangtze River Delta, the Pearl River Delta, and the Beijing-Tianjin-Hebei region posted a nominal GDP growth rate of 5.1%, 4.1%, and 4.4% year on year, respectively, with the Yangtze River Delta growing fastest.

In 2022, the Yangtze River Delta made up 11.8% of the national population, the Pearl River Delta 5.5%, and the Beijing-Tianjin-Hebei region 6.2%. These three major regions concentrated 23.5% of permanent residents in the country. In 2022, the population with permanent residency in the Yangtze River Delta grew by 0.4% year on year, while the Pearl River Delta and the Beijing-Tianjin-Hebei region decreased by 0.4% and 0.3% year on year, respectively. Such decreases were related to the reduction in the number of permanent residents without local household registrations during the COVID-19 epidemic.

In 2022, the Yangtze River Delta accounted for 35.4% of China’s exports, the Pearl River Delta 21.3%, and the Beijing-Tianjin-Hebei region 5.2%. These three major regions combined accounted for 61.9% of the national exports, with the Yangtze River Delta and the Pearl River Delta serving as the primary engines of China’s export industry. In 2022, the export volume in the Yangtze River Delta and the Pearl River Delta increased by 10% and 5.9% year on year, while the Beijing-Tianjin-Hebei region experienced a 0.3% decline.

In 2022, the Yangtze River Delta contributed 35.4% of the country’s container throughput, the Pearl River Delta 22.6%, and the Beijing-Tianjin-Hebei region 8.8%. These three major regions accounted for 66.8% of the national container throughput.

The vitality of the three major megalopolises comes from their enterprises. In 2022, the Yangtze River Delta accounted for 33.3% of the companies listed on the four major stock exchanges in Shanghai, Shenzhen, Hong Kong, and Beijing, the Pearl River Delta 14.2%, and the Beijing-Tianjin-Hebei region 13.9%. These three regions were home to 61.4% of the companies listed on the main boards in China.

Particularly noteworthy is the concentration of IT enterprises in the three major megalopolises. In 2022, the Yangtze River Delta accounted for 27.4% of the IT companies listed on the four major stock exchanges, the Pearl River Delta 19%, and the Beijing-Tianjin-Hebei region 30.3%. These three regions hosted 76.7% of such companies in China, with the Beijing-Tianjin-Hebei region and the Yangtze River Delta taking the largest shares.

The three major megalopolises have fared well in innovation and entrepreneurship. In 2022, the Yangtze River Delta made up 27.8% of granted patents nationally, the Pearl River Delta 17.9%, and the Beijing-Tianjin-Hebei region 8.6%. These three major regions contributed 54.3% of the national granted patents.

In 2022, the Yangtze River Delta were home to 13.9% of the companies listed on the ChiNext board in Shenzhen and the Growth Enterprise Market in Hong Kong, the Pearl River Delta 37%, and the Beijing-Tianjin-Hebei region 19.9%. These three regions represented 70.8% of such companies.

In 2022, the Yangtze River Delta hosted 29.6% of the companies traded on the National Equities Exchange and Quotations (NEEQ) board, also known as the “new third board”, the Pearl River Delta 29.6%, and the Beijing-Tianjin-Hebei region 17.3%. These three major megalopolises concentrated 60.3% of the NEEQ-listed companies.

In 2022, the Yangtze River Delta accounted for 40.6% of unicorn companies in China, the Pearl River Delta 40.6%, and the Beijing-Tianjin-Hebei region 26.5%. These three regions accounted for 86.3% of the country’s unicorn companies.

Zhou Muzhi pointed out, the total GDP of the three megalopolises is 1.5 times that of Japan, their population with permanent residency is 2.7 times that of Japan, their export volume is 2.9 times that of Japan, and their port container throughput 8.8 times that of Japan. He said these figures highlight the position of the three regions in the current world’s economic landscape.

Comparison of 19 megalopolises on major economic rankings of China Integrated City Index 2022

Quasi-first-tier megalopolises race ahead

The Chengdu-Chongqing Economic Circle, the middle reaches of the Yangtze River, coastal areas of Guangdong, Fujian, Zhejiang provinces, and the Guanzhong Plain are all driven by quasi-first-tier regional center cities and have served as the pillar of China’s socioeconomic development.

In 2022, the Chengdu-Chongqing Economic Circle contributed 6.6% of China’s GDP, the middle reaches of the Yangtze River 9.2%, coastal areas of Guangdong, Fujian, Zhejiang provinces 6.9%, and the Guanzhong Plain 2.2%. These four regions collectively made up 24.9% of the country’s GDP. In the same year, the nominal GDP growth rates for the Chengdu-Chongqing Economic Circle, the middle reaches of the Yangtze River 9.2%, coastal areas of Guangdong, Fujian, Zhejiang provinces, and the Guanzhong Plain were 5%, 7.2%, 7.8%, and 8.9%, respectively, with the Guanzhong Plain experiencing the fastest growth.

In 2022, the Chengdu-Chongqing Economic Circle contributed 7.4% of China’s population, the middle reaches of the Yangtze River 8.8%, coastal areas of Guangdong, Fujian, Zhejiang provinces 6.7%, and the Guanzhong Plain 2.9%. These four regions concentrated 25.8% of the country’s permanent residents. In 2022, the number of permanent residents in the Chengdu-Chongqing Economic Circle grew by 0.9%, the middle reaches of the Yangtze River and coastal areas of Guangdong, Fujian, Zhejiang both grew by 0.1%, while the Guanzhong Plain logged a 0.6% decline.

In 2022, the Chengdu-Chongqing Economic Circle accounted for 4.7% of China’s exports, the middle reaches of the Yangtze River 5%, coastal areas of Guangdong, Fujian, Zhejiang provinces 7.5%, and the Guanzhong Plain 1.3%. These four regions contributed 18.5% of China’s exports, with coastal areas of Guangdong, Fujian, Zhejiang provinces surpassing the Beijing-Tianjin-Hebei region in share. In 2022, exports of the Chengdu-Chongqing Economic Circle grew by 5.1% year on year, the middle reaches of the Yangtze River saw a 26.4% year-on-year growth rate, and coastal areas of Guangdong, Fujian, Zhejiang provinces and the Guanzhong Plain grew by 15% and 16.4% year on year, respectively.

Thanks to inland waterway shipping, the Chengdu-Chongqing Economic Circle and the middle reaches of the Yangtze River represented 0.5% and 1.8% of China’s container throughput, respectively. Home to many seaports, coastal areas of Guangdong, Fujian, Zhejiang provinces made up 7.2% of China’s container throughput. The four regions accounted for 9.5% of China’s container throughput.

In 2022, the Chengdu-Chongqing Economic Circle hosted 4.9% of the companies listed on the four major stock exchanges, the middle reaches of the Yangtze River 5.5%, coastal areas of Guangdong, Fujian, Zhejiang provinces 6.1%, and the Guanzhong Plain 1.4%. These four regions were home to 17.9% of the country’s mainboard-listed companies.

In 2022, the Chengdu-Chongqing Economic Circle hosted 2.6% of IT companies listed on the four major stock exchanges, the middle reaches of the Yangtze River 3.6%, coastal areas of Guangdong, Fujian, Zhejiang provinces 6.2%, and the Guanzhong Plain 0.7%. These four regions’ mainboard-listed IT companies accounted for 13.1% of the national total, with coastal areas of Guangdong, Fujian, Zhejiang provinces taking the largest shares.

In terms of innovation and entrepreneurship, in 2022, the Chengdu-Chongqing Economic Circle took 4.6% of the grated patents in China, the middle reaches of the Yangtze River 6.8%, coastal areas of Guangdong, Fujian, Zhejiang provinces 6.9%, and the Guanzhong Plain 1.8%. These four regions took 20.1% of the granted patents in China.

in 2022, the Chengdu-Chongqing Economic Circle accommodated 3.9% of the companies listed on the ChiNext board in Shenzhen and the Growth Enterprise Market in Hong Kong, the middle reaches of the Yangtze River 6.2%, coastal areas of Guangdong, Fujian, Zhejiang provinces 5.3%, and the Guanzhong Plain 1.6%. These four megalopolises represented 17% of such companies.

In 2022, the Chengdu-Chongqing Economic Circle represented 3.9% of companies listed on the NEEQ, the Middle Reaches of the Yangtze River 6.3%, coastal areas of Guangdong, Fujian, Zhejiang provinces 6%, and the Guanzhong Plain 1.9%. A total of 18.1% of the NEEQ-listed companies were concentrated in these four megalopolises.

In 2022, the Chengdu-Chongqing Economic Circle hosted 3.8% of China’s unicorn companies, the middle reaches of the Yangtze River 3.8%, coastal areas of Guangdong, Fujian, Zhejiang provinces 1.6%, and the Guanzhong Plain 0.3%. These four regions accounted for 9.5% of China’s unicorn companies.

Continue to develop megalopolis as main form to advance urbanization

Ming Xiaodong pointed out, the Index is based on large amounts of wide-ranging, authoritative, and accurate data. For the first time, it scientifically categorizes 297 cities at or above the prefecture level and 19 megalopolises in China. The classifications are largely consistent with public perception. This provides the first standard for the comprehensive classification of cities and megalopolises in China and reflects China’s economy. The categorization criteria of megalopolises have enriched understanding of them. First-tier megalopolises accommodate one-third of China’s GDP, and nearly one-fourth of its population, and also gather a large number of listed companies and innovative enterprises. Therefore, first-tier megalopolises are not only areas concentrating population and economy in China, but also major hubs for trade and important sources of innovation. Similarly, quasi-first-tier megalopolises provide crucial support for the development of first-tier megalopolises as important economic centers.”

Du Ping, executive vice director of the State Information Center of China, commented that the Index offers a professional insight into the development of major Chinese cities and its concise and clear charts vividly reveal the performances and rankings of Chinese cities in 2022.

He said, particularly noteworthy is the seven consecutive years of publication, which provides cities with valuable and sequential data for each year. The continuity and objectivity of the Index are instrumental in assessing and comparing cities.

Yang Weimin, former deputy director of the Office of the Central Leading Group for Financial and Economic Affairs of China, noted that the Index distinguishes between first-tier, second-tier, quasi-second-tier, and third-tier cities, and also assesses the development of major megalopolises in China.

He said the major economic rankings show that the Yangtze River Delta, the Pearl River Delta, and the Beijing-Tianjin-Hebei region have maintained their development momentum, while the Chengdu-Chongqing Economic Circle, the middle reaches of the Yangtze River, coastal areas of Guangdong, Fujian, and Zhejiang, and the Guanzhong Plain have been catching up rapidly. The seven megalopolises concentrate over 60% of China’s economy and nearly 50% of its population and such a trend will continue.

He added that this fully proves that taking megalopolises as the main form to promote urbanization, which was set forth in the 11th Five-Year Plan (2006-10), conforms with the laws of development and is far-sighted. Departments at all levels across China should follow the laws of urbanization and continue to take megalopolises as the main form to promote urbanization.

The article was first published on China Daily, China.org.cn on Dec. 29, 2023 and reprinted by other news websites.